I am a self-diagnosed Maximalist. I love big gestures, beautiful loud artistic walls and pieces, and a vibrant mixture of colors. I love the chaos of interior design eye candy. The more visually happening in my space, the better. Though I also love a cohesive space, so where do I draw the line between too much and the perfect balance of maximalism and beauty?

SIDE NOTE: If you have a moment or two check out my two project tabs to see some of our house projects and some organizing projects. Most of the projects were done for others, but the closet one with all the white bins is my closet.

A recent trend among both Gen Z and Millennials is cluttercore. It’s an extreme version of cottage core combined with the maximal of all maximalist versions. Should it be defined as taste or as the new age hoarders, shoving more items into a space than a person’s eyes can digest; an art gallery of things scattered across walls and shelves of a person’s home. The only fortunate aspect of this new aesthetic is that true cluttercore should be limited to one or two rooms or spaces and should be a somewhat focused theme. Even concentrated on one space and theme it seems too intense for me, so hopefully, my version of Maximalism does not extend to the cluttercore extreme. Below are examples of cluttercore (each picture is linked to a different time I used the word cluttercore).

Again, where is the line between my style and the extreme cluttercore? I believe it lies in the amount of stuff I own and how I use and display it. Don’t misunderstand my home is still a lot to the minimalist group who love their white walls, countable kitchen items, and capsule wardrobes. I still decorate for every season. I enjoy a large wardrobe, including a costume closet filled with items for dressing up for many holidays throughout the year.

My parents were champions with money, saving a good amount, putting aside money for my and my siblings’ college, and not buying the most expensive brands of things (cars, clothes, electronics). We were taught to live and save as if things were scarce, or in case of a rainy day, so that if something happened to my dad’s job, or a natural disaster, etc etc, then we would still be fine. I grew up well, never needing for anything. However, high school is a constant competition among peers of who can own the best everything, which naturally leads to always wanting more and more. The latest clothing, or the fancy flip phone that was all the rage circa 2004 when I started high school.

Growing up I was taught to be frugal. Many a time I heard my mom quote President Coolidge’s adage “Use it up, wear it out, make it do [or do without]!” Granted Coolidge said it amidst the shortages the world experienced during World War I and subsequently the great depression. My mother on the other hand was simply trying to teach her children a little resourcefulness, budgeting, and good money management.

An unforeseen repercussion of learning frugality in a time when resources are aplenty is hoarding. I, like many post-depression generations of Americans, began stockpiling things, never able to give anything up. Anything I had ever spent money on I had a terribly hard time letting go. Including every school paper, excess kitchen gear, and even that one shirt I bought from the clearance section for $9, but hated wearing because it fit me funny. Hoarding can become a safety net for some people, especially those who are overly worried about their financial security, and those who have feelings of not having enough in any perceived future. Additionally, hoarding can be a coping mechanism for a person with a mental illness, who finds comfort in things.

Times are tough for a lot of people this year, with inflation, job loss, rising mortgage/housing costs, and expensive groceries. Many emotions, mostly negative, cause people to buy more than they need or more than they can afford. Emotions such as greed, fear, pride, and feelings of scarcity. When times are tough and accounts are overdrawn, or individuals are out of work the spending and “hold onto” genes tend to kick in harder.

My ultimate goal in this journey to a slightly more minimal maximalist life is to find the line between frugality, resourcefulness, and my clutter threshold. The Minimal Mom and Clutterbug channels on YouTube often talk about a person’s clutter threshold. They explain it as the amount of clutter you can handle without becoming overwhelmed and stressed by your stuff. This amount is different for everyone. I am often right at the precipice of, or just past my handling point where my clutter is concerned. So at this point, I still consider myself as somewhat of a hoarder along with my maximal ideals.

Not having every whim fulfilled in childhood may have turned me into a bit of a spender when I became an adult, as I could now spend my money on anything I wanted, and I didn’t need to get permission from the parentals. I get a high from shopping and spending money. Then later when paying my bills, including my credit cards, feel the overpowering regret of spending too much money. For a few years, my husband and I experienced some lifestyle creep (spending closer and closer to our monthly income each month). Upon acquiring our first big kid jobs, where we were earning some real money, it became easy to frivolously spend. We were just a couple of DINKS (Dual income no kids). When everyone around us our age was having first, second, third, and even fourth children, we were only in charge of ourselves and our little dog too.

We got into some money trouble between 2017 and 2019 when we were living beyond our income. I started a business with clothing MLM (which I won’t disparage here), with the idea that I would be successful where others had failed. We were encouraged by our upline to purchase more and more inventory, because “the more you buy, the more you will have to sell. I told myself that I would sell thousands and thousands of products and we would be set. That of course didn’t happen. Luckily, in 2019 and 2020 we figured out how to turn everything around, paying off nearly $100K in debt and saving a downpayment for our first house.

For me, when financial burdens overwhelm and emotional trials devastate my mental stability: advertisements seem more enticing and the lure of the stores calls harder. That bothersome scarcity mindset settles in, and I hand onto every extra scrap of wrapping paper, every free bank pen, clothing that no longer fits, furniture, and home decorations I no longer need. Plus as said I spend. Not a lot of money, but a little bit here and there can turn into a lot.

Now onto my goals for this new blog series. Decluttering and budgeting. Starting where I am now. Well, where I was back in August when I truly started this journey. I first established a better and more straightforward budget. This budget helps me to stay on top of my spending.

- Fixed costs – 60% (Utilities, Health insurance, Auto Insurance, Gas and fuel, Internet, HOA, Mortgage, Cell phones)

- Saving – 10%

- Charity – 11%

- Groceries, Fast food & Fun money -19%

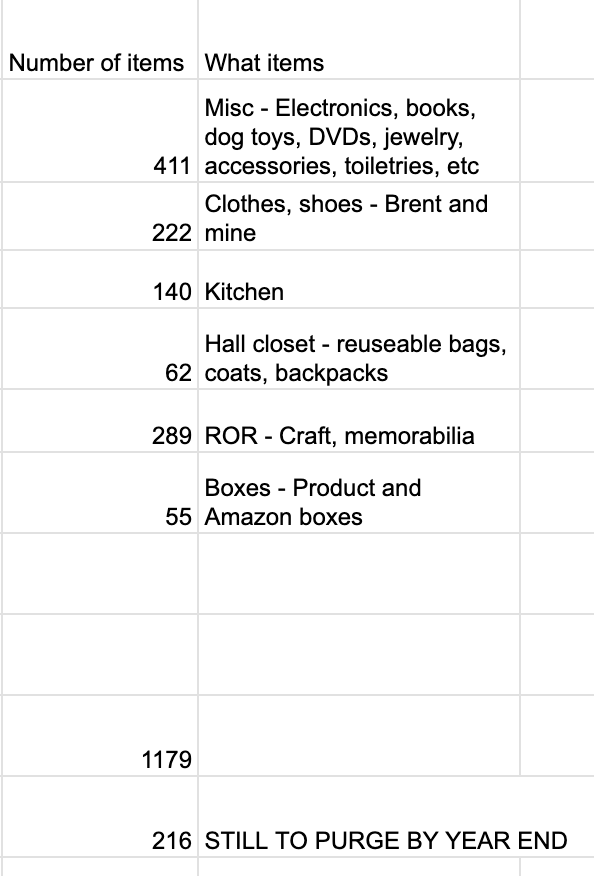

Decluttering: in the last four months I have decluttered almost 1200 items. And boy, do I feel lighter. Not physically lighter I still weigh close to what I did in August, but emotionally not have to stress about the extra 1200 items cluttering up my space. I can now put more time and energy into other important things.

My goal by the end of the year is a total of 1395 items purged from my house and life. This is an amended version of the minimalist decluttering game. The original game is that you get rid of one item times the date number every day for a month. So on the 13th, you must get rid of 13 items, and on the 17th, 17 items. In a 30-day month, this method totals 465 items removed. Since I usually have either a six-hour or a ten-minute organizing attention span, I couldn’t see myself finding the proper number of items each day; some days I would find 8 items, and other days I would find 150 items. So, rather than do this on a monthly basis as the minimalists intended it, I decided to multiply the monthly number (465) by four, for the last five months of 2023 – totaling that 1395 items. Wish me luck I have just over 200 items left to clear out.

All that said am I ready to own 100 items, paint my walls back to white, get rid of my literal library of books (over 1000 books), or create a capsule wardrobe and get rid of everything else? Absolutely not. However, I am trying to heal my relationship with stuff and with money, and head in the direction of a slightly more minimal life and much more meaningful life.

Finally on a completely unrelated note – we watched an amazing Christmas movie tonight: Harry Potter and the Sorcerer’s Stone, and I just happened to be wearing my shirt with the lines from the chess scene at the end of the movie. My shirt is the first one in this video with the leopard print crown 😉

[…] have to constantly be cleaning. There is quite a bit of truth to that, although some of the other organizing and decluttering work we did last year has helped greatly in keeping our house much cleaner on a weekly […]

LikeLike